Instead of spending thousands of Euros and hundreds of hours on learning by doing, we offer you to learn from the best angel investors in only 10 hours. 10 online video lectures 10-20 min each and 12 practical investment assignments. You will understand the high-risk/high-reward investment landscape and gain benefits like:

1. Your investment profile

2. Your investment strategy & risk mitigation

3. Attracting deal flow & your time

4. The investment process & the pitch

5. Exits & interviewing founders

6. Full due diligence

7. Financial analysis

8. Valuation

9. Financial design

10. The Deal and beyond

Self reflection assignments

Investor Interview

Design your Investment profile

Design your Investment strategy

Design your Investment plan

Evaluate a demo startup

Tool 1: Evaluate the pitch

Tool 2: Interview founders

Tool 3: Due Diligence

Tool 4: Financial Analysis

Tool 5: Exit strategi and fictitious valuation

Tool 6: Financial design

Tool 7: Due Diligence Checklist

Tool 8: Syndication & Legal

IRP Summary and decision

Introduction

Johanna Palmér and Björn Larsson

To invest in high risk / high reward

The venture world

Being an angel investor

Heart, brain or gut feeling

What’s your investment profile? Investment goals

Investment capacity

Investment assets

IRP Tool

A: Investment profile

Design your own Investment profile

Introduction

Johanna Palmér and Björn Larsson

The Investment Strategy - part 1

Why do you invest and in what?

The Absolut Criteria strategy

How do other investors think?

Expected return and the investment portfolio strategy

The Investment Strategy - part 2

Your assets

Risk Mitigation by syndication

Relative Criteria

IRP Tool

B: Investment strategy

Design your own Investment strategy

Introduction

Johanna Palmér and Björn Larsson

How to attract and filter deal flow

Types of risk capital

Investment objects or “deal flow”

Deal flow generation

IRP Tool

C: Your investment plan

Design your own Investment plan

Introduction

Johanna Palmér and Björn Larsson

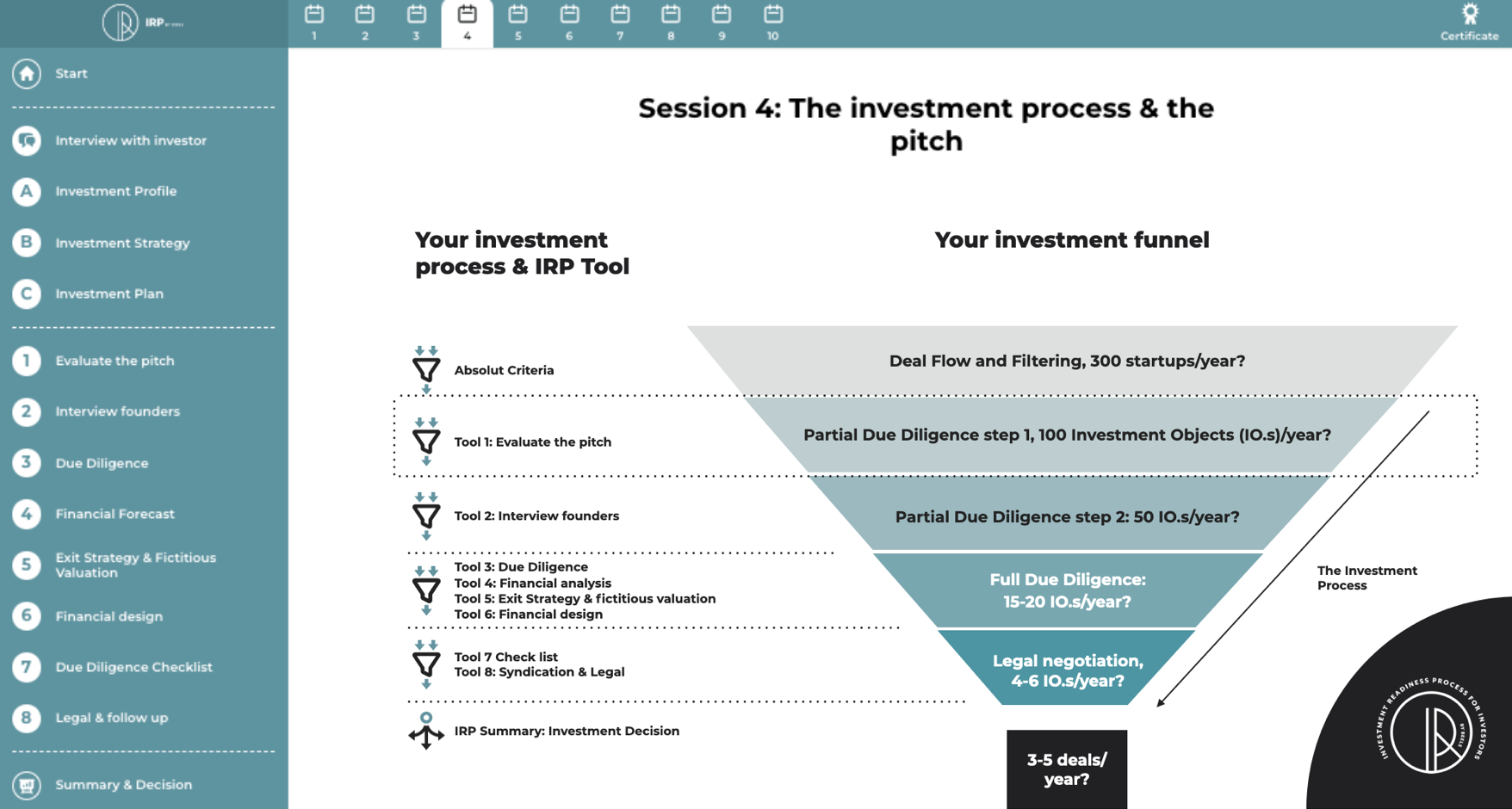

The investment process

Investment funnel and filtering methods

Absolute criteria

Pitch deck format

Relative criteria

IRP Tool

Tool 1: Evaluate the pitch

Practice on a demo startup

Introduction

Johanna Palmér and Björn Larsson

Exit strategies

Risk level

How to sell your shares

Partial Due Diligence

Interview technique

Tech, Market & Team approach

Success factors

IRP Tool

Tool 2: Interview founders

Review the demo startup

Introduction

Johanna Palmér and Björn Larsson

Risk v.s Potential

Potential: Business goals and plan

Risk: Due Diligence evaluation areas

Evaluation & Due Diligence methods

The KTH Innovation Readiness Level™ The VTI Method inspired by STOAF

The IRP Due Diligence Tool

Risk assessment and Expected reward

IRP Tool

Tool 3: Due Diligence

Practice on a demo startup

Introduction

Johanna Palmér and Björn Larsson

Basic Financial Analysis

Financial forecasts analysis

Financial sensitivity analysis

Types of financially sensitive companies

IRP Tool

Tool 4: Financial Analysis

Practice on a demo startup

Introduction

Johanna Palmér and Björn Larsson

Exit strategies and valuations

Funding questions

Exits and valuations

Valuation parameters

Financial metrics

Valuation methods

The Berkus Method

DCF valuation Method

The Market Multiple approach

The VC method

IRP Tool

Tool 5: Exit strategi and fictitious valuation

Practice on a demo startup

Introduction

Johanna Palmér and Björn Larsson

Funding questions

Number of rounds

How much capital in each round

Expected return v.s. risk

Financial design

Existing share holders

Potential exit valuation and total capital

Different types of external capital

Pre money and post money valuations

Understanding dilution effects

Your potential return

IRP Tool

Tool 6: Financial design

Practice on a demo startup

Introduction

Johanna Palmér and Björn Larsson

Syndication & Legal

Syndication

Documentation check list

Types of agreements

MAKING THE DEAL!

Investment Object follow up

Being a supportive owner

Board work

Advisory board

Standard CEO reports

IRP Tool

Tool 7: Checklist

Tool 8: Syndication & Legal

IRP Summary and decision

Practice on a demo startup

Do you want to prepare for raising or investing capital and are interested in doing The Investment Readiness Process? Or maybe you have a question about the content or the process? Feel free to contact us!

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply. See the Google policy FAQ here.

Sign up for the latest IRP Status Report. The report will be sent to your email after signing up.

See our privacy policy to learn more about how we store data.